Wake County Property Tax Rate 2024 Chart Pdf – While it’s very likely Wake County with a $1,176 property tax In 2024, it would be worth $300,000 with a $1,393 property tax In the same time, because of the lowering tax rate, tax bills . You can contact the tax administration to send a duplicate if you misplaced it. The mailing address is: Wake County Tax Administration Attention: 2024 Real Estate Revaluation PO Box 2331 .

Wake County Property Tax Rate 2024 Chart Pdf

Source : www.wake.gov

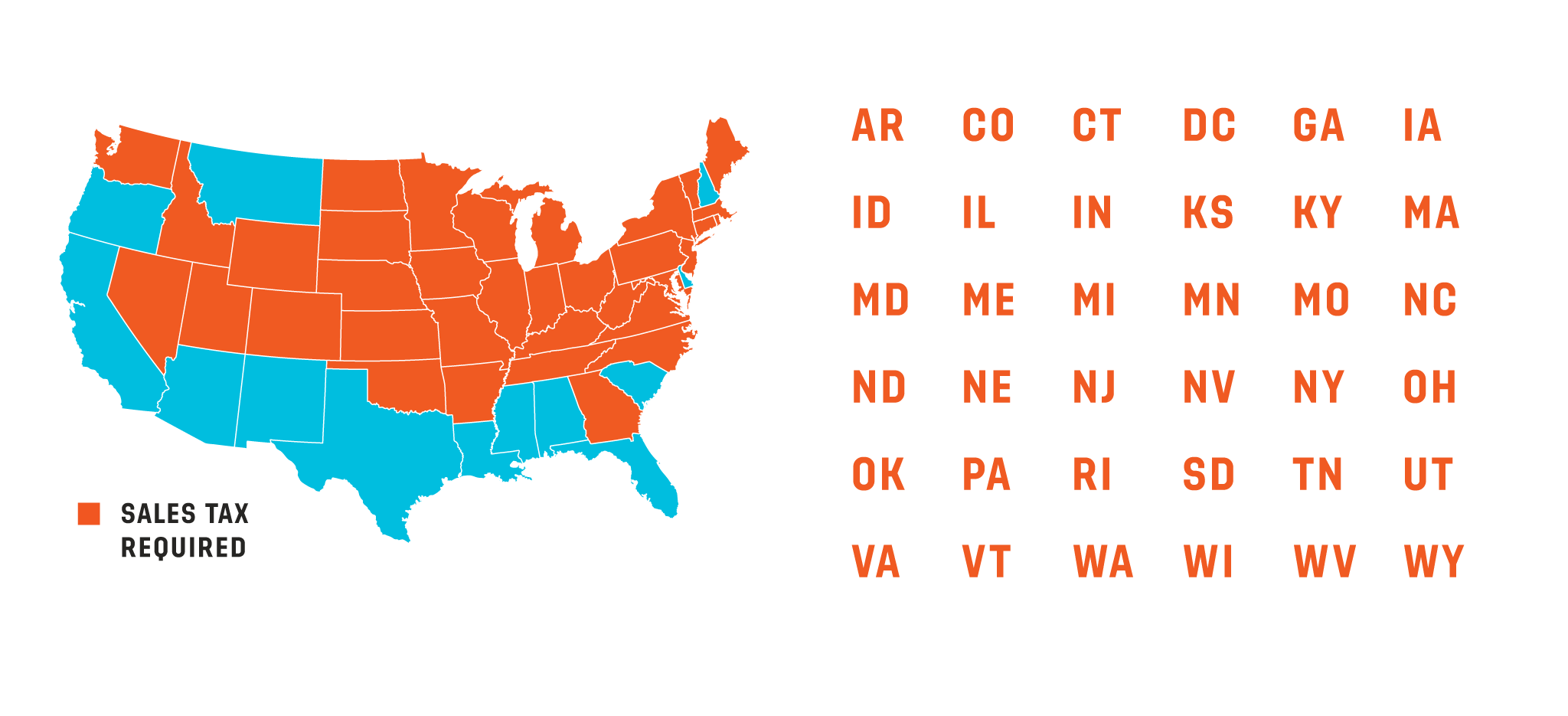

Sales taxes in the United States Wikipedia

Source : en.wikipedia.org

How Your Property Tax Dollar is Used | Wake County Government

Source : www.wake.gov

Sales taxes in the United States Wikipedia

Source : en.wikipedia.org

iMAPS Information | Wake County Government

Source : www.wake.gov

COLORBLENDS | Welcome Landscape Professionals

Source : www.colorblends.com

Revaluation FAQ | Wake County Government

Source : www.wake.gov

Wake Forest Map | Town of Wake Forest, NC

Source : www.wakeforestnc.gov

Dyana Hutto,Realtor

Source : www.facebook.com

Sales taxes in the United States Wikipedia

Source : en.wikipedia.org

Wake County Property Tax Rate 2024 Chart Pdf Fiscal Year 2024 Adopted Budget | Wake County Government: Homeowners in multiple towns across Wake County could see their property rate for the 2024-25 fiscal budget until this summer when the budget process is complete. Based on a revenue-neutral . Wake County homeowners’ homes are expected to increase in value compared to 2020, but property taxes are not expected to jump as much as one might expect. Tax rate decrease proposed as new Wake .